Supercharge Your Business with the

Utah Inland Port Authority

UIPA has an incredible toolkit to support businesses looking to expand or locate

within one of our project areas

Find your public finance tools here

The Utah Inland Port Authority is transforming infrastructure development with our ability to deliver Infrastructure Bank loans, incentive processes, and public financing tools in just 60 to 90 days, outpacing the years-long timelines seen elsewhere.

Our agile decision-making accelerates your projects, ensuring rapid progress.

We emphasize readiness for development, engaging early in infrastructure planning to make sites development-ready, thereby streamlining construction, permitting, and entitlement processes. From well-equipped areas like the Northwest Quadrant to the logistically optimized Cedar City poised for building within the year, we cater to diverse project needs.

This comprehensive approach, encompassing bank loans, area incentives, and tax differential reinvestment, supports businesses in achieving strategic and sustainable development goals in Utah.

Our tools include:

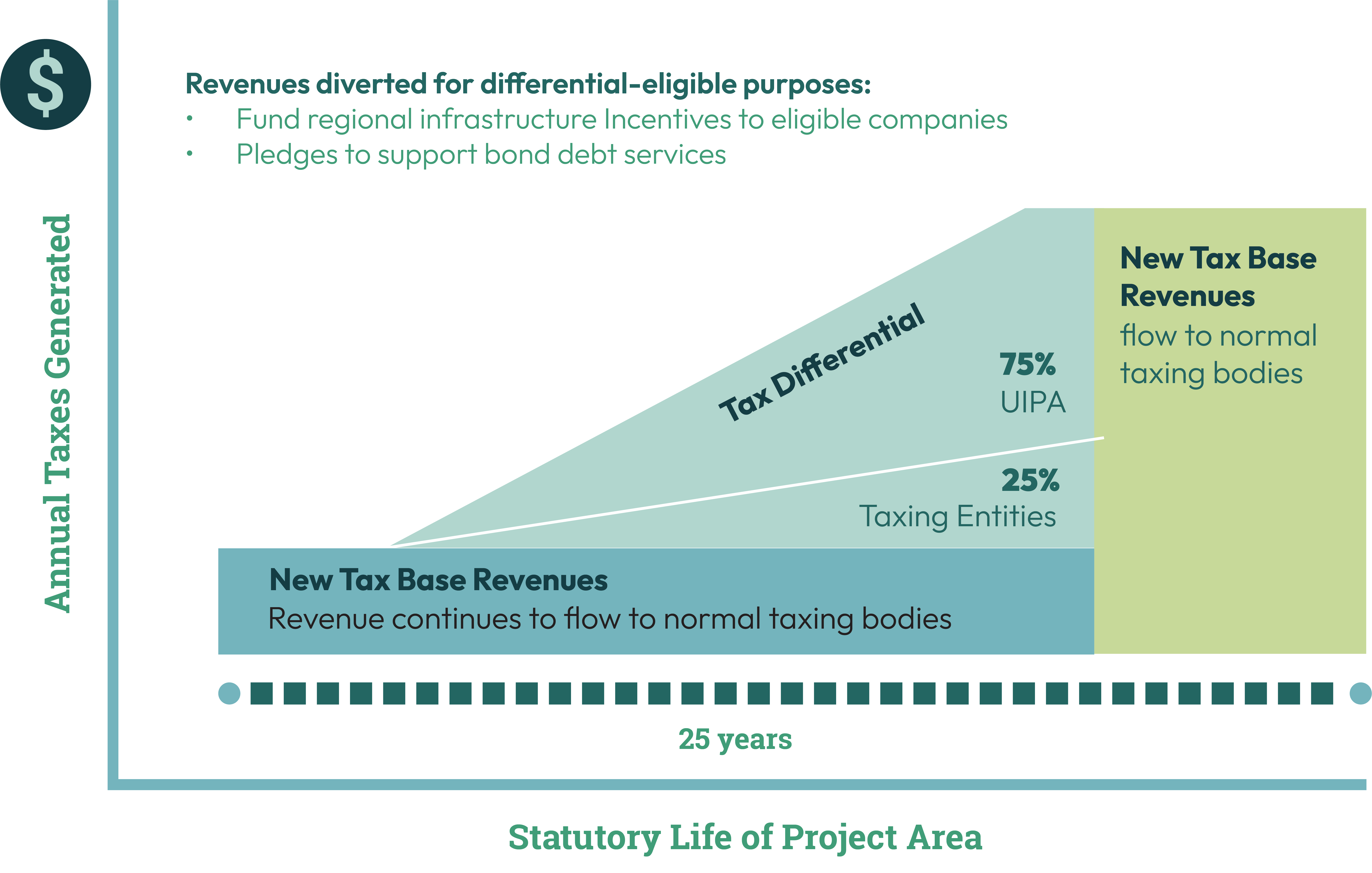

Tax Differential

Grow with us!

Imagine your business flourishing in a hub of innovation and growth, where a significant portion of the taxes you pay is reinvested right back into the infrastructure and services that directly benefit you.

When you choose to locate in our port project area, you're not just renting space; you're investing in a 25-year commitment where 75 percent of new tax revenues are used to enhance regional infrastructure, offering attractive incentives, and ensuring the economic vitality and generational growth of the area.

This means your business operations are supported by robust facilities and a network designed for efficiency. Plus, with a quarter of these revenues supporting local entities, you're also contributing to the broader community prosperity.

Here are other opportunities available across the state:

Rural Employment Development Incentive

The Rural Employment Development Incentive (REDI) grant is designed for businesses creating new high-paying jobs in rural Utah communities.

New jobs can be remote, online, in a satellite hub/office space, or physically located in the same county as the business. Based on the employee’s work location, a business may receive up to $6,000 for each new position.

Economic Development Tax Increment Financing

The EDTIF tax credit is a post-performance, refundable tax credit for up to 30 percent of new state revenues (sales, corporate, and withholding taxes paid to the state) over the life of the project (typically 5-10 years). The incentive is available to companies seeking relocation or expansion of operations to or within the State of Utah who will add at least 50 jobs with annual wages of at least 110 percent of the county average, have demonstrated company stability and profitability, and have obtained a commitment from the local government to provide local incentives.

Industrial Assistance Account

The Industrial Assistance Account is a post-performance grant for the creation of high-paying jobs in Utah. Companies are required to obtain commitment from the local government to provide local incentives, create new high-paying jobs in the state (at least 50 jobs and at least 110% of county average annual wages), demonstrate company stability and profitability, and demonstrate competition with other locations.

Strategic Tax Incentives

The High Cost Infrastructure Tax Credit (HCITC), is an incentive that supports Utah-based projects that expand or create new energy, industrial, mining, manufacturing, or agricultural activity, are comprised of at least 10 percent (or $10,000,000) of infrastructure costs, and generate new state revenues that are directly attributable to new infrastructure investment.

Custom Fit Training

Custom Fit provides customized training for businesses to support workforce development and enhance Utah’s economic vitality. The program is funded by Legislature appropriations and is administered through a partnership between Utah System of Higher Education Custom Fit institutions, the state of Utah, and local businesses.

Revolving Loan Funds

Numerous RLF programs have been established in the state to promote economic development within Utah. RLFs are a gap financing measure used primarily for development and expansion of small businesses. Communities in Utah offer RLFs to provide access to a flexible source of capital to be used in combination with more conventional sources. Often RLFs act as a bridge between the amount a borrower can obtain through private market funding and the amount needed to start or sustain a business.